SUDAN

SUDAN

The Republic of Sudan with a long history and culture on natural gums of over centuries continues to maintain its worldwide leadership position in the production of gum Arabic. The country’s leadership covers several aspects of this product including organized plantation, production volume, quality control, research, sector organization, training, and value added processing.

The government’s strong support to this sector by way of policy instruments, research and regulatory controls has continued to keep Sudan ahead of the other countries in the management of this natural resource.

The Forest National Corporation on the production side and the Gum Arabic Company Ltd on the quality control, processing and marketing side remain the two key public sector Institutions that anchor the gum Arabic industry in Sudan. These two institutions, which are under the direct supervision of the Ministry of Agriculture and the Ministry of Commerce respectively are complimented by the Sudan Research Agency, the Standards Organization of Sudan, the Gum Arabic association of Sudan, and other public and private sector organizations and stake holders. The result is that controlled data is easily available in Sudan for most purposes.

Sector Reforms

Until the last few years, it was impossible for any other organization to buy gum Arabic in Sudan or export gum Arabic out of Sudan: a monopoly maintained by the state institution, the Gum Arabic Company Ltd. But the last ten years has witnessed a continued change in the global market trend for gum Arabic both from the supply and demand ends of the market divide.

With the continued quality and production improvement of the gum Arabic produced in Nigeria and Chad and with strategic market alliances with overseas processors, consumers are turning to Nigeria and Chad as major suppliers of quality gums.

With certification of A. Seyal (a product which Chad and Nigeria have comparative advantage over Sudan) by the Codex Alimentarius Commission in 1998 as qualifying Pari par so with A. Senegal for food and pharmaceutical applications, Sudan’s leadership of the world market for gum Arabic became endangered leading to inevitable policy reforms. The result was that the Government of Sudan between 1996 and 2004 licensed ten companies to buy gum Arabic freely from Sudan, but can only export it in its processed form. The ten companies have all installed gum Arabic processing plants in Sudan.

The aim of this policy is to grant overseas processors more direct access to raw gum Arabic of Sudan’s origin, break the buying monopoly of GAC, and introduce competition in the local market for gum Arabic to enhance market efficiency. This policy has worked very well as most overseas processors who established Kibbling plants in Sudan have changed the local market dynamics by bringing farm gate and producer prices almost to the level of international export prices.

Producer Price Levels

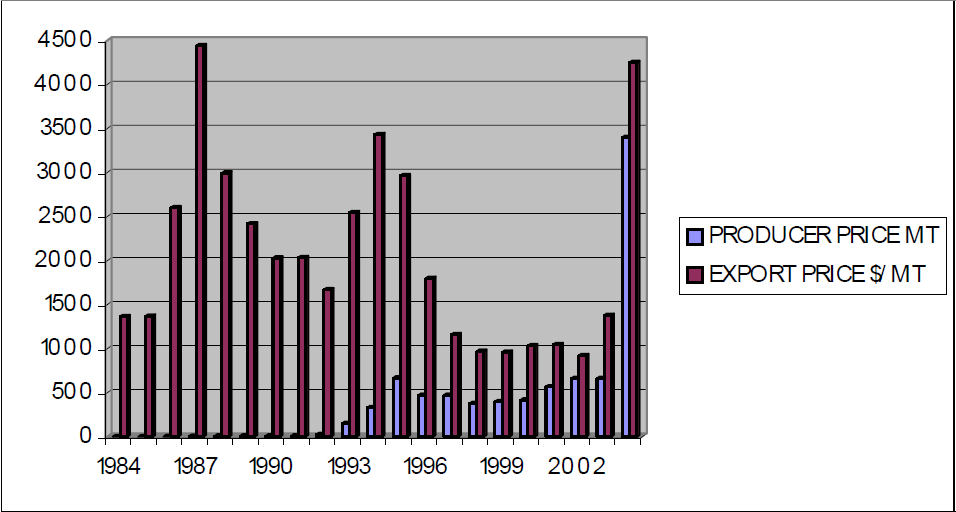

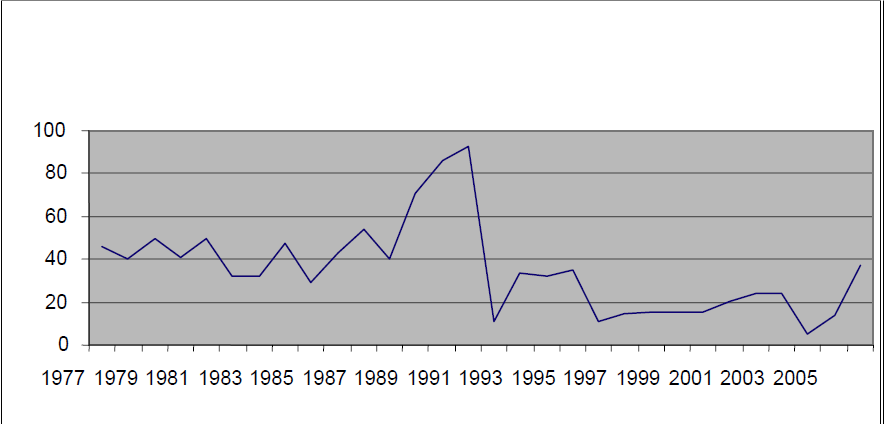

Table , shows the producer and export price levels of gum Arabic from A. Senegal in Sudan from 1975 to 2004. Figure 4 reveals the extent to which the rural producers of this natural commodity have been underpaid. Over the years, producers at the farm level have been paid producer prices less than 15% of the export prices of gum Arabic, leaving the rural dwellers that produce natural gums at increasing poverty levels not with standing the increasing fortunes of this commodity in the international market. This has been one major reason why more than 60% of Sudan’s gum Arabic remains unexploited.

However with the recent policy changes which allows private processors to buy raw gum direct from farmers and faced with imminent world shortages, producer price jumped to USD 3500 pmt in Sudan in 2004: the highest producer price paid for nearly 90 years of the history of gum Arabic in Sudan. This is approximately 78% of the export price of about USD 4500 which Gum Arabic (A. Senegal) sold in 2004.

With this enhanced producer price, it is almost certain that farmers will be encouraged to produce more gums in the coming season if a reasonable producer price level is maintained. A likely indirect consequence of the enhanced 2004 producer price is the probability of overproduction in 2005 as a result of the very attractive producer price witnessed in year 2004. This may in turn lead to another round of price crash and a subsequent fall in production.

TABLE : 21 Years Producer and Export Price Levels for A. Senegal

| PRODUCTION | PRODUCER PRICE | EXPORT PRICE |

Year | MT | USD | $/MT |

1984 | 33,235 | 0.76 | 1,365 |

1985 | 26,828 | 0.99 | 1,371 |

1986 | 18,717 | 1.74 | 2,603 |

1987 | 17,744 | 5.68 | 4,440 |

1988 | 18,603 | 7.57 | 2,995 |

1989 | 19,352 | 7.57 | 2,418 |

1990 | 26,912 | 7.57 | 2,029 |

1991 | 24,978 | 8.13 | 2,035 |

1992 | 14,068 | 24.97 | 1,670 |

1993 | 15,730 | 151.37 | 2,545 |

1994 | 22,755 | 331.12 | 3,432 |

1995 | 16,847 | 667.24 | 2,964 |

1996 | 13,722 | 473.03 | 1,798 |

1997 | 22,548 | 473.03 | 1,160 |

199 | 20,989 | 378.42 | 970 |

1999 | 19,928 | 397.34 | 961 |

2000 | 24,179 | 416.26 | 1,034 |

2001 | 20,322 | 567.63 | 1,049 |

2002 | 30,462 | 662.24 | 920 |

2003 | 15,838 | 662.24 | 1,380 |

2004 | 15,000 | 3400 | 4,250 |

Figure 4: Export and Producer Price Differentials Represented by Bar Chart

Figure 4: Export and Producer Price Differentials Represented by Bar Chart

The above cycle of rise and fall of the production and price of gum Arabic leads us to a search for a stabilizing trade instrument which can be found in the establishment of a buffer stock which will release stock to stabilize the market during years of scarcity and purchase excess stocks in years of overproduction.

Production

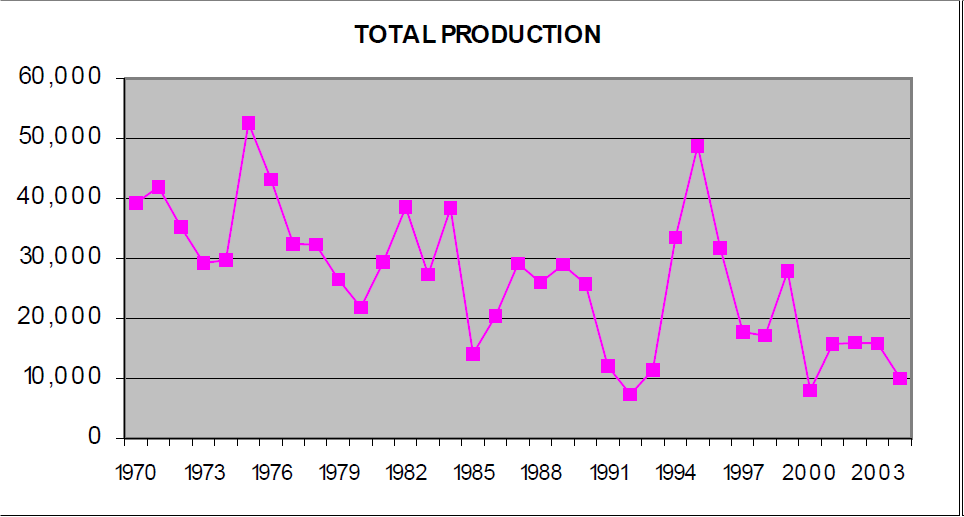

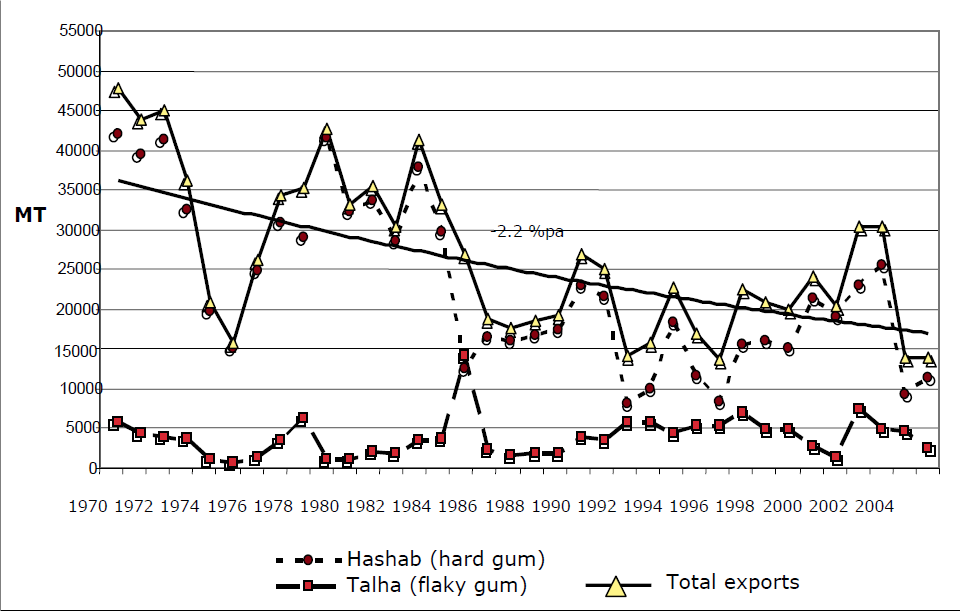

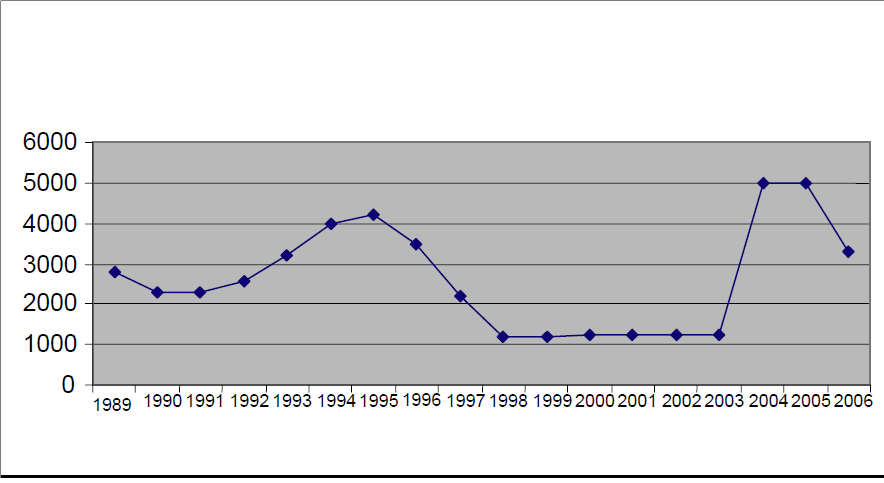

The production of gum Arabic in Sudan in the last 30 years has been very epileptic. There has been a constant rise and fall of the production figures in a manner that is very difficult to explain. Table shows the undulating production figures of A. Senegal and A. Seyal in Sudan between 1970 and 2004. Three years stand out as years of low production in Sudan as evident in Figure . They are: 1992, 2000 and 2004.

Figure: Graphic Representation Of Growth In Production Of Gum Arabic In Sudan.

The low production of Gum Arabic in Sudan between 1990 and 1993 was as a result of a combination of severe drought, locust and quiller bird invasion and discouraging low producer price paid to farmers. On the other hand, the low production in the period of 1999 and 2000 is unlikely to be a result of either drought or locust invasion. It is more likely that the low production was triggered off by:

♦ Effect of Certification of A. Seyal as gum Arabic under same definition as A. Senegal.

♦ Continued low producer prices. Year 2004 has again Witness a very low production of A. Senegal in Sudan. This shortage is attributable to the following factors:

♦ Continued discouraging producer price.

♦ Complete erosion of the buffer stock previously held by Sudan.

♦ Continued desert encroachment within Sudan.

♦ Continued locust invasion within the gum Arabic belt.

♦ The war in Darfur, which falls within the gum Arabic belt.

TABLE. Production Figures Of A. Senegal and A. Seyal in Sudan.

YEAR | A. Senegal | A. Seyal | TOTAL PRODUCTION |

1970 | 35,063 | 4,195 | 39,258 |

1971 | 38,616 | 3,313 | 41,929 |

1972 | 31,468 | 3,743 | 35,211 |

1973 | 25,940 | 3,307 | 29,247 |

1974 | 23,464 | 6,259 | 29,723 |

1975 | 46,500 | 6,100 | 52,600 |

1976 | 43,000 | 200 | 43,200 |

1977 | 32,141 | 275 | 32,416 |

1978 | 32,200 | 130 | 32,330 |

1979 | 26,287 | 206 | 26,493 |

1980 | 20,699 | 1,166 | 21,865 |

1981 | 24,367 | 4,984 | 29,351 |

1982 | 31,984 | 6,561 | 38,545 |

1983 | 22,555 | 4,720 | 27,275 |

1984 | 34,00 | 4,360 | 38,360 |

1985 | 11,313 | 2,775 | 14,088 |

1986 | 18,047 | 2,375 | 20,422 |

1987 | 25,268 | 3,877 | 29,145 |

1988 | 20,000 | 6,000 | 26,000 |

1989 | 24,256 | 4,692 | 28,948 |

1990 | 22,408 | 3,325 | 25,733 |

1991 | 11,466 | 595 | 12,061 |

1992 | 7,152 | 177 | 7,329 |

1993 | 9,955 | 1,455 | 11,410 |

1994 | 22,409 | 11,049 | 33,458 |

1995 | 39,303 | 9,455 | 48,758 |

1996 | 30,291 | 1,434 | 31,725 |

1997 | 17,746 | 13 | 17,759 |

1998 | 12,479 | 4,639 | 17,118 |

1999 | 21,165 | 6,679 | 27,837 |

2000 | 3,576 | 4,393 | 7,969 |

2001 | 12,009 | 3,696 | 15,705 |

2002 | 12,855 | 3,074 | 15,929 |

2003 | 13,973 | 1,865 | 15,838 |

Source: The Gum Arabic Company, Sudan

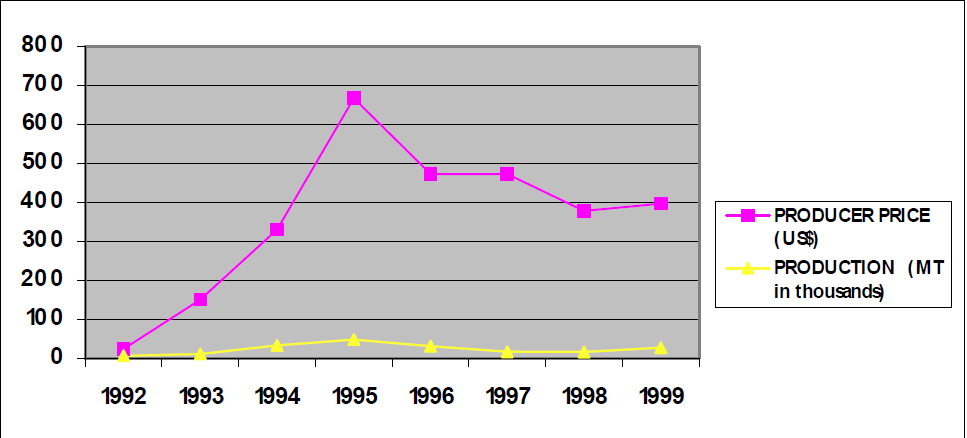

The period from 1992 to 1999, as shown in Table 8 and illustrated in Figure, brings out a strong positive correlation between producer price level and volume of production. There is a strong indication that the more income the farmers get for the gum Arabic they produce, the more the gum Arabic they produce. This relationship is very pronounced in Sudan where there is state control of the gum Arabic trade.

Table: Producer Price as a Critical Factor to Volume of Production of Gum Arabic (1992-1999).

YEAR | PRODUCER PRICE | PRODUCTION |

| USD | MT (000) |

1992 | 24.97 | 7.329 |

1993 | 151.37 | 11.410 |

1994 | 331.12 | 33.458 |

1995 | 667.24 | 48.758 |

1996 | 473.03 | 31.725 |

1997 | 473.03 | 17.759 |

1998 | 378.42 | 17.118 |

1999 | 397.34 | 27.837 |

Figure: Producer Price and Production of Gum Arabic (1992 – 1999)

Potential Production

According to the Forest National Corporation, at full capacity, Sudan has the potential to produce up 80,000 MT of A. Senegal. This means that Sudan’s average utilization of its production capacity in the last five years is under 25%. Given the partial liberalization of the gum Arabic business in Sudan, the increasing world demand, the complete erosion of the buffer stock in Sudan and the enhanced producer price of gum Arabic in Sudan, production is expected to step up in 2005 and in the years ahead.

Marketing of Gum Arabic in Sudan

The marketing of gum Arabic produced in Sudan is still dominated by the Gum Arabic Company (GAC), an agency of the Sudanese Government. Not withstanding the licenses granted to ten private companies to engage in the processing and export of gum Arabic, GAC claims that it is still responsible for the purchase and export of over 70% of gum Arabic produced in Sudan. This dominance is due to an in-depth market relationship built with the extensive network of farmers, farmer groups and suppliers of gum Arabic in Sudan. For example, in year 2004, when Sudan is estimated to have produced about 10,000mts of A. Senegal, GAC alone claims to have purchased 7,000mts out of this quantity. While the ten processing plants in Sudan were responsible for the purchase and sale of the remaining 3000mts.

The range of grades of Gum Arabic produced and traded by Sudan includes:

| A. Senegal | A. Seyal |

Cleaned | * | * |

Hand Picked Selected (HPS). | * |

|

Cleaned and Sifted. | * |

|

Kibbled | * |

|

Siftings. | * |

|

Dust | * |

|

Powder | * |

|

A very high percentage of the gum Arabic produced in Sudan is still exported in its raw form, either as cleaned, HPS, Sifted or Siftings. Buyers of Sudanese gum Arabic are spread all over the world including Europe, The United States of America, India, South America, Asia and Japan, among others.

Local Uses and Market for Sudanese Gum Arabic

The local market for Sudanese gum Arabic is built around the local uses of gum Arabic. In Sudan, Gum Arabic is traditionally believed to have the following functional uses:

♦ Raises human immune level especially for pregnant women.

♦ Helps digestion as a fiber.

♦ Has supernatural powers to drive away evil spirits and white witches.

♦ Treatment of kidney failures.

These beliefs form the basis of an aggressive local market effort by the Ministry of Commerce of Sudan.

Consequently gum Arabic is consumed locally in Sudan to perform the above functions. Gum Arabic is sold in small measures of about 250gm in the local market at an average price of $1 per pack. It is also sold in beautiful commercial packages of about $2 per pack. The volume of local consumption of gum Arabic is unknown but it is believed to be substantial.

Value Added Local Processing

Like in many developing countries of Africa, value added processing of gum Arabic in Sudan has not been a success story. The first gum Arabic Kibbling/Milling plant (KGAPC) established in Sudan over 15 years ago was not successful until it was bought over by The Gum Arabic Company Ltd (GAC). Both the Gum Arabic Company and KGAPC are Government owned. Government is not very good in running commercial enterprises. The ten companies licensed by the Sudanese Government to process gum Arabic for export are still struggling to find their feet. Although they are involved mostly in gum Arabic kibbling which is the most rudimentary form of gum Arabic processing, the most successful ones are those owned by established oversea processors of gum Arabic, like AGRISALES, CNI, and ALFRED WOLF.

Of the ten processing companies, only the plant owned by Alfred Wolf has a sprayed drying facility, which are the latest advances in the processing of gum Arabic. The failure of the indigenous processing plants in Sudan is attributed to:

♦ the difficulty of marketing processed gum Arabic in the International markets.

♦ The conspiracy of existing international processors.

♦ The highly capital intensive nature of gum Arabic processing.

The above problems are however not insurmountable given the success story of the spray drying facility in Nigeria whose productions are overbooked and unable to meet the demand of overseas customers.

IJCEBS

International Journal of Chemical, Environmental & Biological Sciences (IJCEBS) Volume 3, Issue 5 (2015) ISSN 2320–4087 (Online) (2000-2014)

Sudan Gum Arabic Export Performance during(2000-2014)

Abstract

Sudan is predominately an agricultural country, with over 90% of its exports supplied by the agricultural sector. Agriculture is the basic economic activity accounting for more than 35% of Gross Domestic Product (GDP). The average share of exports in GDP for the period 2000-2014 is 35.7%. The exports of Sudan are dominated by agricultural products. Sudan is the main exporter (80%) of gum Arabic in the world. Other exporting countries include Chad, Nigeria, Senegal, Ethiopia and some other African countries. Exports of gum Arabic fluctuated due to unstable policies, competition from other countries and unstable production. This study conducted to examine the effects of Sudan gum Arabic exports prices on the quantities during 2000-2014. The study used secondary data obtained from relevant official sources. It carried out the percentage to calculate the concentration of gum Arabic by countries and companies during 2000 – 2014. The results of the study illustrated that the proceeds of Gum Arabic exports fluctuated during the period, but in general overview it has an increasing trend and the export price and total production have positive effects on exports quantities.

Keywords

Gum Arabic, North Kordofan, Sudan.

- INTRODUCTION

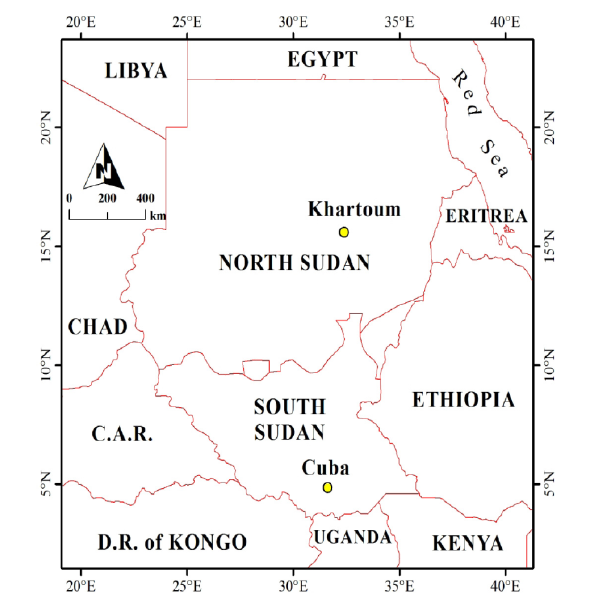

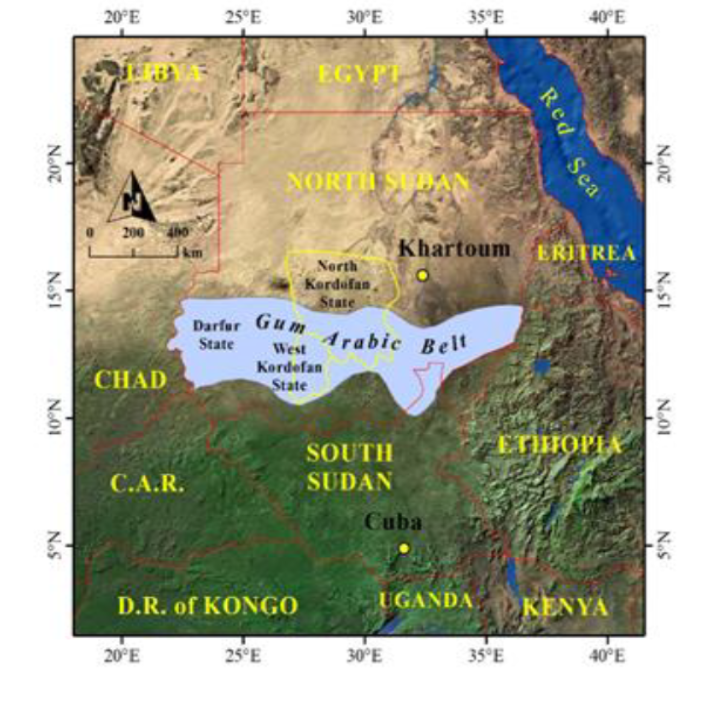

SUDAN is a vast country in Africa with an area of 1.9 million square kilometers. It is located in the north- eastern part of Africa. Between latitude 23˚ 8′ and 8 ˚ 45′ North and longitudes 21 ˚ 49′ and 38 ˚ 34′ East, and extends along the maritime border on the Red Sea coast, and is bounded by two Arab countries are (Egypt and Libya) and 7 African countries. The total population in 2008 was about 33.4 million people [6]. (Fig .1.) shows the Sudan location.

Fig. 1): Sudan Location

Agriculture plays an important role in Sudan economy, it contributed an annual average of 35 % to total GDP during the 2000-2014 and in addition it accommodates about 80% of the employment. The agricultural sector constitutes the components of agriculture agrarian and animal, agrarian production includes the traditional rain-fed and mechanized agriculture, irrigated agriculture, forest and pastures. Sudan is considered one of the most important Arab and African countries in the area of animal resources and its products, which contribute to export and achievement of food security and provide various types of meat and dairy products for domestic consumption.

Forestry in Sudan includes wood products in form of firewood, charcoal and timber and non-wood products in form of wild fruits and gum products, particularly gum Arabic. Forestry also provides protection of watershed, fodder for domestic animals and wildlife. Gum Arabic is an essential forest product that produced in gum Arabic belt, which stretches from the western border with Chad to the eastern border with Ethiopia. The gum Arabic belt covers an area of about 500 thousand square km. The Belt is home to roughly one fifth of the population of Sudan. Figure (2) demonstrate Gum Arabic belt in Sudan.

Fig. 2 Gum Arabic belt in Sudan

Gum Arabic is the dried exudate produced from the trunk and branches of the Acacia Senegal tree, known as hashab, and the Acacia Seyal tree, known as Talha [2] and [7]. Gum Arabic is used in various industries such as food, beverages, medicine, soft drinks and chewing gums.

Sudan is considered as a key supplier of raw gum Arabic in the world as it used to provide more than 80% of high quality gum Arabic in the world market [3], [4] and [5]. During (2000-2014) exports of gum Arabic fluctuated.

Sudan gum Arabic exports fluctuated due to unstable production and unstable policies. As a result of the poor performance of the exports of this strategic commodity in the world market and the need for improving it in the future, the Government of Sudan undertook positive steps towards deregulation of the Gum Arabic Company (GAC) concession rights in 2009 to provide incentives to producers to reactivate their production in favor of increased exports. The government established the Gum Arabic Board (GAB) for free gum Arabic trade in domestic and export markets, when many companies compete in gum Arabic exports.

This study aim to:

Estimate the effect of produced quantities and export prices on gum Arabic total exports during (2000-2014).

The study used secondary data in order to investigate the empirical relationship between the level of gum Arabic production, export prices and the export quantities (2000-2014).

The study used the multiple linear regression analysis method. It is unquestionably the most widely used statistical technique in the social sciences and also widely used in the biological and physical sciences. The coefficients represent the change in the value of the dependent variable for a unit change in one independent variable, assuming other independent variables being constant.

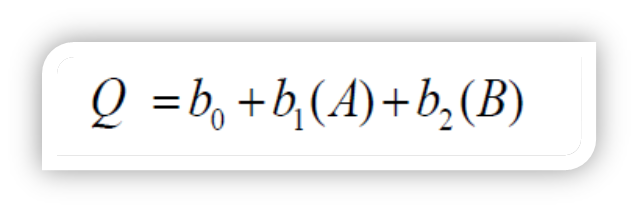

The multiple linear regression model is written as straight forward extension of:

Where:

Q: Quantities of gum Arabic exported in tons per year (the dependent variable).

A: Export price (US$).

B: Production quantity (ton).

b0: intercept.

b1 and b2: represent the corresponding regression coefficients.

Results:

The Main Importing countries of Sudan gum Arabic:

The main importing countries were France, USA, Italy, Germany and Japan during 2000-2014 (table 1). Except for France which had increasing imports, the other countries had declining imports throughout the three periods of 2000-2005, 2006-2010 and 2011-2014. On average France imported about 50% of its total exports value of gum Arabic from Sudan.

TABLE I

MAJOR IMPORTING COUNTRIES BY 000 US$ DURING 2000-2014

Period | France | United States | Italy | Germany | United Kingdom |

2000-2005 | 12,034 | 6,640 | 6,889 | 10,812 | 11,424 |

2006-2010 | 18,394 | 5,197 | 4,032 | 3,290 | 5,610 |

2011-2014 | 20,394 | 4,188 | 2,61 | 2,308 | 2,079 |

Source : Bank of Sudan. (2000-2014). various annual reports

The performance of gum Arabic production and Exports in Sudan:

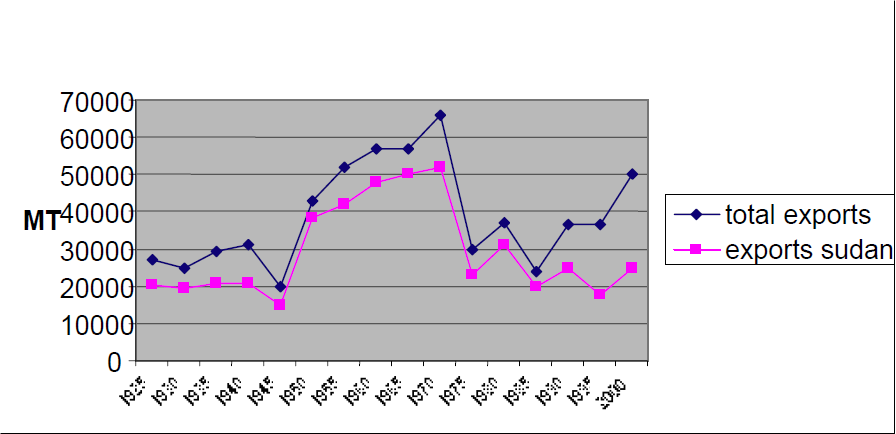

During 2000-2014, the exports of gum Arabic from Sudan had fluctuated between about 23 thousand tons in 2002 to 32 thousand tons in 2008 and down to 18 thousand tons in 2010, largely drop due to the drop in production. But in recent years the exports about 60 thousand tons in 2013 and 2014, this large increase due to increase in production and the increase in international prices, also to the regulation of gum Arabic trade by Gum Arabic Board. ( Figure 3.) below shows the patterns of quantities and values of exported gum Arabic during the same period. The performance of gum Arabic exports during 2001-2014, indicates an average export of 34 thousand tons of gum Arabic obtaining US$ 61 million during the period. And it seemed in all has an increasing trend during the period.

TABLE II

SUDAN GUM ARABIC EXPORTS DURING (2000-2014)

Explanatory variable | Regression coefficient | t- statistics | Level of significance |

Constant | 23550.47 | 3.462179 | 0.005 |

Export price | 0.6514 | 0.113551 | 0.912 |

Total production | 0.5768 | 2.46177 | 0.031 |

R2 = 65%

F = 10.6

Table (II) gives the results of the analysis. The coefficient of determination R2 was found to be equal to 65%, which meant that about 65% of the variations in gum Arabic exports during the period could be attributed to the export price and total production. The rest of the factors, about 65% could be attributed to other variables not captured by the regression model. However, the value of the F-test which was over 10.6 indicated the overall significance of the model.

The regression results indicated the existence of the positive relationship between the level of gum Arabic exports and the level of export price and total production during the cited period.

Gum Arabic exports price had a coefficient of 0.6514, which was significant at 1% level. This meant that as the exports price increase by one unit, when other variables remaining constant, the total export of gum Arabic would increase by 0.6514 units per year.

Gum Arabic production had a coefficient of 0.5768, which was significant at 10% level. This meant that as the total production increase by one unit, when other variables remaining constant, the total export of gum Arabic would increase by 0.6514 units per year.

Since there is no evidence about increasing gum Arabic exports and unstable pricing and taxing policy on production, marketing and exports of gum Arabic, the study inference its recommendations from the non-captured portion of the regression model result. Therefore, the study recommends to study the factors upon fluctuations of production, especially drinking water during tapping and collection periods, factors behind smuggling of the crop out of the country and facilitating rational pricing and marketing policies to encourage more production of the gum Arabic commodity.

BY:

GHADA A. M. Yasseen[1] ,

ADIL Yousif Eljack[2]

and MOHAMMED Elawad Dafa Ella Ahmed[3]

- GHADA1 Ahmed Musa. Yasseen, University of Dalanj , Dalanj, Sudan, Phone: +249634837022, Mobile: +249912123553, Email: gadayasseen@yahoo.com.

- ADIL2 Yousif Eljack, Sudan – Phone: +249122621052, Mobile: +249122076748, Email: adelneel@yahoo.co.uk

- MOHAMMED3 Elawad Dafa Ella Ahmed: Sudan – University of Dalanj. mail; drmoh70@yahoo.com ).

REFERENCES

[1] Bank of Sudan. (2000-2014). various annual reports.

[2] FAO. (1999). Production Yearbook, Vol. 53, Rome, Italy.

[3] FAO [Food and Agriculture Organization]. 2005. ―Forest Resource Assessment 2005‖. FAO, Rome Italy.

[4] Larson B. A. (1991). Natural Resource Prices, Export Policies and Deforestation: The Case of Sudan. World-Development, Vol. 19, No. 10: 1289-1297.

[5] Macrae, J. 2002. ―The prospects and constraints of development of gum Arabic in Sub-Saharan Africa‖. Washington, D.C., World Bank.

[6] Sudan Central Bureau of Statistics. (2009). the results of the fifth census in 2008. Central Bureau of Statistics- Khartoum – Sudan.

[7] Yasseen, Ghada A. M. (2001). Constraints of Gum Arabic Production and Exports: A case study of North Kordofan State. M.Sc. Thesis, University of Khartoum, Sudan.

CASE STUDY

THE IMPACT OF MARKETING STRATEGY ON EXPORT PERFORMANCE

Abstract:

This study aims to examine the impact of marketing strategy on Sudan Gum Arabic exports performance. It is an attempt to contribute to solve the problem of huge decline and fluctuation of Gum Arabic production and exports in last decay. This decline had led to drop in revenues. Many factors were behind this problem; part of them are naturally as drought, and mainly are human made as lack of policies and strategies of both government and the Gum Arabic Company (GAC), which was monopolized gum Arabic exports till recent years. The main object of the study was to evaluate the impact of marketing strategies and policies on gum export performance. More precisely the study focused on marketing practices applied by the company. The study has formulated some hypotheses, concluded to that; Sudan marketing strategy is ineffective. Data has conducted through questionnaire, personal meeting, records and observation. Statistical Package of Social Studies (SPSS) has used to test the hypotheses and get results. The results confirmed that, ineffective marketing strategy of Gum Arabic Company (GAC) mainly caused in the drop of the exports revenue and lowered Sudan world market share.

Keywords:

Gum Arabic, Marketing, Capability, Marketing Strategy, Gum Arabic Co.

1-Introduction

Gum Arabic is a dried exudate from stems and branches of Acacia Senegal or Acacia seyal. It is the oldest and best –known of the natural gums mixture of polysaccharides and glycoprotein gives it properties of a glue and binder, which is edible by humans. In the past, it has used as a wine fining agent, (Vivas et al 2001). Currently Gum Arabic is an important ingredient in soft drink syrups, M&M’s chocolate candies, and edible glitter, a very popular, modern cake-decorating staple. For artists, it is the traditional binder used in watercolor paint, in photography for gum printing, and it is used as a binder in pyrotechnic compositions. Gum Arabic used as an emulsifier and a thickening agent in icing, fillings, chewing gum and other confectionary treats, (Laura & Glenn 2009).

Pharmaceuticals and cosmetics also use the gum as a binder, emulsifying agent and a suspending or viscosity-increasing agent, and recently it been investigated for use in intestinal dialysis, (Smolinske 1992).

Production of gum Arabic in Sudan is concentrated in the “gum belt” an area of central Sudan roughly between latitudes 10o and 14o north. The Gum belt’s gross area estimated to cover 520,000 square kilometers, roughly quarter of current Sudan’s total area (after south separation). It spans over eleven states and consists the four main regions; North Kordofan, South Darfur, Blue Nile and South Kordofan.

Small-scale farmers in traditional rain-fed farming areas (central and western Sudan) mostly produce Gum Arabic; they represent up to 20 percent of Sudan’s population, or around 6 million people. Main producers usually give priority to food crop production (usually sorghum or millet) and seek other sources of income to increase their financial returns via cultivation of gum Arabic. Sudan annual production varies from one year to anther due to weather conditions (draught), insufficient funding for producers, and tribal conflict (War in Darfur). Historically Sudan was the main supplier of raw gum Arabic, with a market share of about 80%.Exports dropped from 60 thousand metric tons a year in 1960s-70s to about 30 thousand metric tons a year in 1980s-90s, rising again in the 2000s -2010s to about 35 thousand metric. Sudan annual supply with pronounced variation between 25 and 35 thousand metric tons, averaging about 30 thousand metric tons. It represents between 40-50% of world supply.

Internal marketing;

Internal gum Arabic marketing in Sudan is free and take place at auctions competition. Merchants licensed to buy at auction must immediately make payment after the auction. The minimum price can be paid at auction is the (Floor Price), i.e., the official price of the government. Gum Arabic Company must buy non-bought gum at auction at official floor price. Most producers usually sell their products directly to the company through its local agents. Gum Arabic company handles cleaning, sorting, packaging and export processing.

Taxes and duties are imposed on gum at locality level and states level, in additional with taxes are collected on the way from production areas to export port, where GAC has its stores. Taxes represent between $200 and $400 per metric ton. Most producers claim that taxes represents a major barrier to the development of the sector (GAC 2010).

External marketing;

External gum Arabic marketing in Sudan were monopolized over raw gum by GAC over last forty years in order to regulate exports to increase the revenue and to guarantee production to protect producers through the provision and to maintain gum Arabic trees. In 2002, Sudan government permitted to investors who cultivate certain area with gum trees to export raw gum Arabic. Currently only one company exporting raw gum from its planation. Since 2003, processed gum exports allowed for the companies obtain licenses. Many companies granted licenses, including the four main GAC international agents who established processing facilities in Sudan (crushing facilities to make “cleaned grade”)in order to ensure improved supply for their processing lines in Europe and America. Later on, in 2009, GAC concession withdrawn allowing more firms to trade in raw gum Arabic in order to revive gum Arabic production. This situation caused increasing of completion between GAC, its international agents and other processors pushed up prices paid to producers.

International marketing;

Global raw gum Arabic production comes mainly from Africa. As no production figures are available, only export statistics give an idea about scale of production. Annual world production varies according to weather condition and price status. During the period of ten years (2001-2010), exports developed with remarkable variation between 25 thousand tons to 95 thousand tons, averaging 50 thousand tons a year. Sudan, Nigeria, and Chad are the main producers; they produce together about 95% of the world gum Arabic export (Table-1). Based on export statistic, researchers estimated current world annual demand between 80 -100 thousand tons. It has kept up by increasing consumption of soft drink and confectionary, beside new applications developed in dietary and health foods. Future perspectives for development of gum Arabic are good, demand projected to reach 150 thousand tons in 2020, (FAO-2010). The major importers are Europe and United States, as they both account for about 80% of global raw gum Arabic trade (Eurostat-2013). Most of imported gum processed in Europe and USA and then re-exported. As per CBI, 2012 majority of re-exported gum Arabic handled by European countries. In fact, the key gum Arabic merchants and manufacturing companies are located in France, the United Kingdom and Germany. These three countries re-exported about 83% of total gum Arabic. France, to date, remains the leading importer and re-exporter worldwide of gum Arabic. France achieves more of crude value-added, makes the greatest profits on its re-exports.

Gum Arabic Company (GAC)

Gum Arabic Company has established in 1969 as public company, with exclusive concession to export raw gum Arabic. The main objective was to regulate exports to increase exports revenue, guarantee production and product producers. This concession continued for more than forty years, until it polished in 2009. The board of the GAC is consist of ten members, three representatives of the government which owns 30 percent of GAC’s shares, four representatives of producers through the Farmers Union which owns 20 percent of shares and three representatives of individual shareholders who is approximately about five thousand, own 50 percent of the shares. The company (GAC) is involved in purchasing, preparing and exporting raw gum Arabic. The organizational hierarchy of the company is consist of four main departments; finance &investment, administration affairs, commercial affairs, and technical & research. Marketing is a section of commercial affairs. Approximately about 500 employees are working in the company. The GAC monopoly on raw gum Arabic polished in 2009.The company (GAC) has negatively affected by the last changes in gum Arabic marketing arrangements. GAC sales to its usual clients dropped, as result of clients starting to source kibbled gum from Sudanese processors. GAC international agents now have their own processing facilities in Sudan. So GAC now suffering weak marketing capacity and facing many challenges threat to its survival, so government support is highly required to avoid its collapse.

2- Literrature Review

Marketing has had several definitions, each of them was stems from the idea is consistent with the period in which it was considered the importance of marketing by the men of the administration. At initial stages, marketing were not exceed function of trade, and on this basis American Marketing Association (2013), defined marketing, as “do various commercial activities for the flow of goods and services from sources of production to the markets of consumption and use”. Marketing is the process of communicating the value of a product or service to customers. Marketing might sometimes interpreted as the art of selling products, but sales is only one part of marketing (Baker 2008). As the term, “Marketing” may replace “Advertising” it is the overall strategy and function of promoting a product or service to the customer (Smolinske 1992). From a societal point of view, marketing is the link between a society’s material requirements and its economic patterns of response. Marketing satisfies these needs and wants through exchange processes and building long-term relationships. The process of communicating the value of a product or service through positioning to customers. Kotler, 1984 stated that, marketing can looked at as an organizational function and a set of processes for creating, delivering and communicating value to customers, and managing customer relationships in ways that benefit the organization and its shareholders. Marketing is the science of choosing target markets through market analysis and market segmentation, as well as understanding consumer-buying behavior and providing superior customer value. There are five competing concepts under which organizations can choose to operate their business; the production concept, the product concept, the selling concept, the marketing concept, and the holistic marketing concept. The four components of holistic marketing are relationship marketing, internal marketing, integrated marketing, and socially responsive marketing. The set of engagements necessary for successful marketing management includes, capturing marketing insights, connecting with customers, building strong brands, shaping the market offerings, delivering and communicating value, creating long-term growth, and developing marketing strategies and plans (Vivas et al 2001). As per Kotler and Armstrong (1996), effective marketing starts with a considered, well informed marketing strategy. A good marketing strategy helps you define your vision, mission and business goals, and outlines the steps you need to take to achieve these goals. Your marketing strategy affects the way you run your entire business, so it should planned and developed in consultation with your team.

It is a wide reaching and comprehensive strategic planning tool that:

- Describes your business and its products and services.

- Explains the position and role of your products and services in the market.

- Profiles your customers and your competition.

- Identifies the marketing tactics you will use.

- Allows you to build a marketing plan and measure its effectiveness.

Kotler & Conner (1997), stated that marketing strategy sets the overall direction and goals for your marketing, and is therefore different from a marketing plan, which outlines the specific actions you will take to implement your marketing strategy. Your marketing strategy could developed for the next few years, while your marketing plan usually describes tactics to achieve in the current year.

Marketing strategy is a process that can allow an organization to concentrate its resources on the optimal opportunities with the goals of increasing sales and achieving a sustainable competitive advantage, (Smolinske 1992). So marketing strategy includes all basic and long term activities in the field of marketing that deal with the analysis of the strategic initial situation of a company and the formulation, evaluation and selection of market-oriented strategies and therefore contribute to the goals of the company and its marketing objectives. Marketing strategy composed of four elements called marketing mix or 4Ps. Marketing mix (product, price, promotion, and place) are the elements an organization can and must control in offering its product to the market as per McCarthy (1960) who is the first one who proposed this framework, which has dominated and informed the understanding of marketing principles (Gronroos 2006). This framework has not only offered useful guide to major categories or marketing activities (Czinkota & Kotabe 2001), but it has also provided the organizing framework for “almost all marketing textbooks and courses” (Shapiro, etal,1985). Performance defined in business dictionary, as the accomplishment of a given task measured against preset known standards of accuracy, completeness, cost, and speed. According to Molly (2013), to assess accurately how well a business is performing, one needs to develop some quantifiable measures by identifying those aspects of the business process that need improvement and that are working well. This can then use to evaluate the company productivity over a set period.

3-Previous Studies

Marketing literature suggests that that firms use capabilities to transform resources into outputs driven by their marketing mix strategies and that such marketing capabilities can affect their business performance (Vorhies & Morgan, 2003 &2005; Morgan, Vorhies &Mason, 2009).

Many previous research studies have conducted to understand the different impact of marketing mix capabilities on export performance. Taiwo (2010) has indicted that, strategic marketing practices have a significant impact on performance variables and that interact with the different components to facilitate performance. This statement confirms the observations of earlier studies (Day & Montgomery, 1999; Johne & Davies, 2002; Folan et. al, 2007; Franco Santos et.al, 2007). Studies showed positive relationship between product capability and export performance. Lages, Silva and styles (2009) reported that product strategy is the key driver of export performance and product quality is the top determinant of export performance. It is essential for exporting firms to have capable international distribution channels. Wilkinson and Brouthers (2006) contend that distribution capability, whether through distributors or direct international channels ,allows export firms access to customers in foreign markets, gain important local-market knowledge, and provide necessary marketing services. Distribution capability can have differential effects on the export performance of firms due to the different requirements and aspiration of non-exporters, early exporters, and advanced exporters (Leonidou &Katsikeas, 1996; Leonidou 2004). Some pervious research studies have reported that distribution network availability and cooperative partnership between the manufacturer and the export channel have a positive effect on export performance (Style & Ambler, 2000; Leonidou et al, 2002; Lages & Montgomery, 2004; Lee &Griffith, 2004, Sousa & Bradley, 2009).

Promotional capability allows firms to adapt to foreign markets and target the right customers with effective integrated marketing communications (Blesa & Ripolle, 2008). So export managers need to devise incremental promotional strategies characterized by gradual adjustment to market condition (Lages, Jap & Griffith, 2008). In the later stages of export development, firms with superior marketing communication capability are able to persuade global consumers to purchase their products that are available in the targeted foreign markets (Murray et al, 2011). Hultman, Katsikeas and Robson (2011) stated that export promotion strategies are more effective in increasing export sales for firms with greater experience in the specific foreign markets.

4-Statement of the problem

After close to forty years of concession to GAC, to manage export of gum Arabic, the results showed in the followings:

I-Downfall of Sudan world market share to less than 50%.

Ii-Decline of production and exports annually, at average rate of 3 percent.

Iii-Lower producers return.

Iv-Emerge of close competitors.

V- Increasing of smuggling via boarders.

5-Objective of the study

The main purpose of this study is to assess the impact of marketing strategy and policies on gum Arabic export performance in Sudan, beside the following sub objectives:

- To identify options to change current marketing practices in order to increase gum exports.

- To open new markets for export.

- To maximize the value added to exports.

- To develop and increase the production.

- To satisfy producers with fair floor prices and return.

5.1-Research hypothesizes

To attain the objectives of the study, the following research hypothesizes have been set based on the revelation in the review of literature concerning relationship between marketing capabilities and export performance.

Hypothesis 1

There is strong relationship between the product capability and export’s performance.

Hypothesis 2

There is strong relationship between the pricing capability and export’s performance.

Hypothesis 3

There is strong relationship between the distribution channels capability and export’s performance.

Hypothesis 4

There is strong relationship between the promotion capability and export’s performance.

6-Research Methodology

6.1 Data collection

Data collection has conducted from primary and secondary resources. The secondary data resources were library researches, published material and worldwide web. While primary data was collected via questionnaire. Questionnaire designed to measure the capabilities of Gum Arabic marketing strategy. Questionnaire formulated based on four independence variables of marketing mix, which were product, price, place (distribution) and promotion. The dependent variable was export performance that considered in terms of; world market share, export volume, export revenue, and producers return. The study generally displayed gum Arabic export over forty years, focusing on the last ten years.

Total of (200) questionnaire were distributed, (178) was returned with response rate of (87%). Some of retuned questionnaire excluded due to incomplete information. As result (173) questionnaire considered as valid for test. Overall (40) questions were developed to be answered based on Five Points Likert Scale (one= strongly disagree to five= strongly agree) as it is considered to be an easier approach to collect data (Yu and Egri 2005). It is important to mention that, the survey instrument translated and back translated.

6.1.1 Sampling

The target population of this study made up of all gum Arabic producers in the four main production regions in Sudan. From GAC producers record list (200) respondents were selected randomly, (50) for each region, using random technique.

6.1.2 Variables

Respondents had asked to indicate their perception about marketing capabilities exercised by the company. The four marketing capabilities measured by two-item five-point rating scales ranging from (1) much lower to (5) much higher. Product capability measures the company exported products quality and degree of diversification. Promotion capability measured by assessing the company promotion budget and effectiveness of promotion activities in international markets. Distribution capability captures the company distribution budget and effectiveness of distribution activities in international market. The operationalization of this study is consistent to Zou et al. (2003). A four –item five point Likert scale, measures export performance. These four items capture the perceived the international market share growth, export volume growth, export revenue growth, and producers return growth. These items are adapted from Katsikeas et al (2000) and Diamantopoulos &Winklhofer (2001).

6.1.3 Test of reliability

Reliability test is conducted based on Cronbach Alpha to measure internal consistency of questionnaire, results was fall between (0.75) and (0.85), which is valid value, because satisfactory should be more than (0.60) for the scale to be reliable (Malhotra 2002). The overall Cronbach alpha of all scales used in this study was (0.80).

7-Data analysis and results discussions

7.1 Respondents demographics

All respondents were male (this due to the hindrance and toughness of this business). As per (table-1) majority of respondents (80%) posses B.sc degree, (6%) posses M.sc, and (14%) possess secondary school certificate. This distribution shows that most of the respondents are highly educated people, who could know the concept of marketing strategy. Most of the respondents (56%) have 5-9 years experiences in this field, that indicate the respondents actually spent enough time to know the impact of marketing strategy on performance of Gum Arabic exports.

7.2 Statistical methods

The statistical methods used in this study were:

7.2.1 The mean, which is most commonly used measure of central tendency, researchers have used to measure the average answers of respondents.

7.2.2 Standard deviation, which is the most used tool to measure the depression and concentration of respondents answers from the arithmetic mean. Deviation value less than (1.00) refers to the concentration of the answers and lack of dispersion, while deviation above (1.00) shows lack of concentration and dis person.

7.2.3 T-test, it is used to determine significant differences on certain points (center hypothesis of the study) or the differences between t wo means.

Statistical Package of Social Studies (SPSS) has used to test the hypothesis.

7.3 Hypothesis testing

Due to the testing of the study hypothesis, (table-2), shows the correlation values that accomplish the objectives of this study. According to (Welkowitz, Cohen and Ewen 2006) correlation coefficient is very useful way to summarize the relationship between two variables with a single number that falls between(-1and +1). (-1) indicates a perfect negative correlation, (0-0) indicates no correlation, and (+1) indicates a perfect positive correlation.

First hypothesis

Result showed that, there is a significant positive correlation between the product capability and export’s performance as per (table-2). This is due to the value of correlation which is 0.674 at the statistical significant level of ( =0.05) and standard deviation value of 0.745 which is less than (1.00), that indicates high concentration and lack of dispersion. Most of gum exports are in raw form, there is no product diversification.

Second hypothesis

Study result showed, there is a significant positive correlation between the pricing capability and export’s performance. This clearly observed from correlation value, which is 0.882, and standard deviation value of 0.624(table-2). Respondents complained of low prices received by farmers pushed them to favor crop cultivation over gum Arabic trees.

Third hypothesis

Figures showed a significant positive correlation between the distribution capability and export’s performance. This refers to the correlation value of 0.792 and standard deviation value of 0.675(table-2). Most exports directly sold to main four international agents. This cartel has strong influences on exports prices and formed oligopoly of buyers.

Fourth hypothesis

Table result showed a significant positive correlation between the promotion system and exports’ sales. This refers to the correlation value, which is 0.829, and standard deviation value of 0.735(table-2). Sales depend on only one element of promotion mix (personal direct selling).Others elements as advertising, sales promotion, and publicity are not active.

7.4 Discussion & findings

The hypotheses test confirms significant positive correlation between marketing strategy and gum Arabic exports performance. As per T-square test, pricing capability and distribution capability showed highest positive correlation with exports sales performance, which means that they has maximum contribution toward exports sales performance. While product strategy showed the least positive correlation.

In last ten years (2004-2013), Sudan gum Arabic exports performance showed a little bit improvement due to later Government changes in marketing arrangements. The return to producers increased in the last five years (2009-2013) from 100 SDG/Kantar (one Kantar = 100Lbs) in 2009 up to 850 SDG in 2013 (table-6). This increase was due to high competition on domestic market. Despite of producers increased returns, but this increment mostly absorbed by high inflation rates that average between 35-45 percent a year as per reports of Sudan Central Bureau of Statistics (SCBS-2014).

Last decade export quantity showed some variations and slightly increases (table-3); export dropped from 27,444 MT in 2004 down to 16,316 MT, by rate of about 40% , this may be due to international financial crisis. However, in next year (2008) quantity increased by rate of 132% to reach 37,860 MT(table-3), this increase may be considered as an attempt from importers to compensate last year lower purchase. In the last five years, amount exported rose 50%, that is, from 36,636MT in 2009, to 55,079 MT in 2013.

Despite of increased export quantity, but Sudan world market share is still between 45%-47% (table-5). This is due to increase of international demand and competitors (Nigeria & Chad) well export performance. Nigeria and Chad emerged as important producers in 1990s. In years 2009/2010, Nigeria and Sudan have been competing for first place in worldwide exportation (table-4). Chad, which primarily exports (Talha) gum, became increasingly important from the end of the 1990s with exports of between 10 to 17 thousand metric tons. Depending on the year, averaging 12.5 thousand metric tons a year between 2001 and 2010 (table-4). Nigeria & Chad global market share is growing; even most of their gum exports are of Seyal grade. They are both export about 50% of global supply.

Sudan export rates are instable due to supply variation, (table-3)show the price was about US$ 1500/MT in 2003/2004, shooting up to above 5000 US$/MT in 2005/2006 , dropping back to 3000 US$/MT in 2008/2009, staying in 2500 US$ in 2001/2012. Obviously observed; production volume and supply influence the price.

Monetarily, Sudan’s exports between 2004 and 2009 amounted to more than USD 456 million (table-3), with annual average amount of about USD 91million. While it amounted to more than 639 USD in the period from 2009 to 2013, with annual average amount of about USD 127 million (table-3). The amount value of the last year exports was more than USD 134 million as the highest revenue in the last ten years.

The main impact of key strategy and policy changes over the last ten years on gum Arabic exports performance represented in; a- an increase of production and export by the rate of 100%, as it increased from 27,444 to 55,079 MT(Table-3). b- An increase in producers return from 75 to 850 SDG, by rate of about 103% (Table-3).

By X-rayed the marketing capabilities of Gum Arabic in Sudan; the researchers reached to the following findings:

a- Most of those involved in marketing process at GAC are not highly marketing oriented. Marketing manager is an economist; the assistant marketing manager is an engineer, the procurement manger is an accountant etc. This situation had negative implication on implementation of marketing programs.

b- Producers insufficient income due to gum low prices pushed them to cultivate others commodities of high income.

c-The company concerned on one major promotional tool (direct marketing), and ignores others promotional mix elements.

d- The company direct selling to few international agents led them to form monopoly cartel.

e- Sudan product supply strategy mainly depends on raw gum, and neglects others product diversification forms.

f- Fluctuation of gum supply (exports) affected negatively on the Sudan creditability.

g- Government limited budget of scientific research, had bad effects on awareness to develop gum sector.

h- High taxes and duties imposed on gum local trade, which represents 40% of export price, directly increased total product cost.

7.5 Recommendations

Based on the findings, the researchers suggest the following recommendations:

a-For the company (GAC), it has to do the following:

-It must change its strategy and structure to cope with current development in the gum market.

-It has to introduce training scheme to enhance attainment of sales and marketing objectives to survive under current high completion.

-It has to recruit right efficient professionals in its management and administration positions, precisely in marketing.

b-For the Sudan government, it has to do the following:

-Provide remunerative price (Floor Price) leads to increase production prevents gum production drop.

-Expand its foreign agents via applying other promotional mix elements, to avoid domain of certain cartel.

-Product diversity leads to satisfaction of each customer and increase the volume of exports and then return.

-Cancel all taxes, fees, and duties imposed on the trade of gum Arabic.

-Enable and encourage local processing and manufacturing of gum, in order to maximize add value to exports.

-Set and execute a prompt marketing strategy to develop gum Arabic sector, including

research, improved technology transfer and reforestation.

-Support producer’s organization and helping them to access new technologies to increase yields and tapping.

-Encourage reaches in global market to get opportunities via understand changing structure on demand, monitoring breakthroughs in substitute’s development.

-Maintain buffer stock inventories to protect against production interruptions.

Sudan has to work to put and execute strategic plan aims to increase production in a sustainable manner and advanced to meet the requirements of the growing global demand, with appropriate pricing of gum. Because the stability of prices, encourages sustainability and increasing global demand and creates a strong partnership with customers. Sudan has to avoid speculation and price increases in times of scarcity and low supply, because it pays consumers to work on reducing the quantitative demand, and push them to search other sources, also lead to the development of synthetic substitutes.

Better, for Sudan if it wants to reap the biggest benefit of its gum, it must first stops the export of crude gum, and then enters a valuable partnership that works with international companies in the manufacture of gum.

8- Conclusion

The primary purpose of this study was to examine the impact of marketing strategy on gum Arabic export performance in Sudan. The results of the study showed that, marketing capabilities of both, the Gum Arabic Company (GAC), and the Sudan government were insufficient. Therefore, it caused in drop of production and exports and lead to lowered Sudan world market share. Despite of positive effects of last changes in strategy and policy, but still Sudan global market share is below 50%. The results of the study contribute to understand the impact of marketing capabilities on export performance. The study can explain which marketing capabilities contribute to export performance by assessing the differential role of marketing capabilities. Our findings suggest several ways that an exporter can improve export’s performance. Among the four marketing capabilities, pricing and distribution showed greater significance to export performance. Marketing capabilities are not the exclusive determinant force on export performance, such uncontrollable factors of microenvironment as suppliers, competitors, customers do affect export performance. Beside macro environmental factors as economic, technology, demography, and sociocultural. Results showed the significant managerial implication on export performance.

Although this study has contributed to marketing literatures, but we have to consider its limitations. Most significantly, this study focused on one company and country, this may limit the generalizability of the findings to other environmental and country contexts. Future research should validate the findings of this study using data obtained from other countries. Therefore, the findings of this study may be transferable to other African competitor’s gum Arabic exporting companies and countries as Chad and Nigeria exhibit similarity in their exporting product and exporting marketing capabilities.

The study approach takes conventional view of marketing capability. so future researches should test the impact of other nontraditional types of marketing capabilities on export performance. Such as organization-level marketing capabilities and competitive advantages. Furthermore, researches can be conduct on aspects related to what factors enable or hinder development of marketing capabilities.

BY:

1-Hamza Ahmed Mohamed and 2- Rogia Suleiman Mohamed Al-Shaigi

Assistant Professor College of Business, Khaulais Branch, King Abdul-Aziz University King of Saudi Arabia

E-mail: Hazemo-9969@hotmail.com

References

[1] Bateson, William M., Sudan Gum Arabic Sector: Analysis and operation (Victoria press London-1980).

[2] Boone Louise E., Kurtz David, Contemporary Marketing: (Dryden press int London 1992).

[3] CBI Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer.

[4] Czinkota, M.R & Kotabe, M. (2001), “Marketing Management”, second Edition, College Publishing, South-Western-Cincinnati.

[5] Day, G. & Montgomery, D. (1999), “Charting New Directions for Marketing.” Journal of Marketing, 63 (Special Issue), 3-13.

[6] Dennett peter D. and Kassariaian Harold Hconsumer Behavior (Englewood cliftsNJ Prentice Hall Inc.1972).

[7] Diamantopoulos, A. & Winklhofer, H.M.2001. “Index construction with formative

indicators,” Journal of Marketing Research, 38(2: 269-277. Diamantopoulos, A. &

Winklhofer, H.M. 2001. ‘Index construction with formative indicators,’ Journal of Marketing Research, 38(2): 269-277.

The Impact of Marketing Strategy on Export Performance 1632

[8] FAO.2010. Guidelines on sustainable forest management in dry lands of sub-Saharan

Africa. Arid Zone Forests and Forestry working paper No.1.Rome.

[9] Folan, P., Browne, J. & Jagdev, H., (2007), “Performance: Its Meaning and Content for

Today’s Business Research”, Elsevier Performance Measurement Special Issue 58 (7), 605- 620.

[10] Franco-Santos, M., Kennerly, M.M., Pietro. M, Veronica, M., Steve, M., Bernard, G. & Dina N. A. (2007), “Towards a Definition of a Business Performance Measurement System”, International Journal of Operations and Production Management 27 (18). 784-801.

[11] Gronroos, C. (2006), “On Defining Marketing Finding a New Road Map for Marketing, “Marketing Theory, 6 (4), 395-417.

[12] Harga Mohamed El Amintrees shrub of the Sudan(Ishaca press Extent- UK.1990). http://siteresources.worldbank.org/INTAFRMDTF/Resources/Gum_Arabic.

[13] Johne, A. & Davies, R. (2002), “Innovation in Medium-sized oil Companies: How

Marketing Adds Value”. The International Journal of Bank Marketing 18 (1).

[14] Katsikeas, C.S., Leonidou, L.C & Morgan, N.A.2000. “Firm-level export performance

assessment: review, evaluation, and development”, Journal of the Academy of Marketing Science, 28(4:493-511.

[15] Kotler PhilipMarketing Management(Prentice Hall InternationalInc.London

1984).

[16] Kotler, P. & Armstrong G. (1996), “Principle of marketing, seventh edition, Prentice

Hall of India Private Limited. Connaught Circus, New Delhi.

[17] Kotler, P. & Connor, RA, (1997), “Marketing of Professional Services”, Journal of

Marketing 5(4), 12-18.

[18] Laura Halpin Rinsky, Glenn Rinsky (2009). The Pastry Chef Companion: A

Comprehensive Resources Guide for the Banking and Pastry Professional.

[19] McCarthy, E.J. (1960), “Basic Marketing: A Managerial Approach”, Irwin, Homewood, IL.

[20] Molly, T (2013), “Definition of Performance Measurement”, Demand Media, Retrieved on 29/10/2013, (online):

http://smallbusiness.chron.com/definition-performance-measurement-45759.html. 1633 Hamza Ahmed Mohamed and Rogia Suleiman Mohamed Al-Shaigi

[21] Morgan, N.A., Vorhies, D. W. & Mason, C.H. 2009, “Research notes and commentaries market orientation, marketing capabilities, and firm performance”, Strategic Management Journal, 30(8): 909-920.

[22] Shapiro, B.P. Dolan, R.J. & Quelc, J.A. (1985), “Marketing Management Principles,

Analysis and Applications”, Irwin, Homewood, IL.

[23] Smolinske, Susan C. (1992).Handbooks of Food, Drug and Cosmetic

Excipients.p.7.ISBN 0-8493-3585-X, 9780849335853.

[24] Stanton WilliamFundamentals of Marketing: (MC Graw Hill Book Co. Inc. new York 1975).

[25] Sudan Central Bureau of Statistics annual reports -2014.

[26] Taiwo, A.S, (2010) “Strategic Marketing Strategies on the Performance of Firms in

Nigerian Oil and Gas Industry”, “Journal of Emerging Trends in Economics and

Management Sciences” 1 (1), 23-46.

[27] Virhies, D.W. & Morgan, N.A. 2003. “A configuration theory assessment of marketing organization fit with business strategy and its relationship with marketing performance”, Journal of Marketing, 67 (1): 100-115.

[28] Vivas N, Vivas de Gaudlejac N, Nonier M.F and Nedjma M, (2001). Effect of

Gum Arabic on wine astringency and colloidal stability, Progres Agricole ET Vitiole.

[29] Zou, S., Fang, E. & Zhao, S.2003. ‘The effect of export marketing capabilities on export performance: An investigation of Chinese exporters’, Journal of International marketing, 11 (4):32-55.

Illustrations

Table (1) Demographics of the respondents. (N=173)

Characteristics | Frequency | Percentage |

Sex | ||

Male | 173 | 100% |

Female | 0 | 0% |

Level of education | ||

Secondary | 87 | 50% |

B.sc | 66 | 38% |

M.sc | 20 | 12% |

Years of experience | ||

Less than 5 years | 41 | 24% |

5-9 years | 76 | 44% |

10-14 years | 44 | 25% |

15 and above | 12 | 07% |

Source: survey data-2014.

Table (2) Correlation between marketing capability and export

Hypothesis | Correlation | Sig. | Std. Deviation |

Product capability | 0.674 | 0.000 | 0.745 |

Pricing capability | 0.882 | 0.000 | 0.624 |

Distribution capability | 0.892 | 0.000 | 0.675 |

Promotion capability | 0.729 | 0.000 | 0.735 |

Source: survey data-2014.

Table (3) Sudan Raw Arabic Gum Exports Volumes and Values (2004-2013)

Year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

Quantity M/T | 27444 | 33078 | 23149 | 16316 | 37860 | 36636 | 48598 | 45633 | 52357 | 55079 |

Value M$ | 41248 | 103107 | 128245 | 73764 | 109945 | 128263 | 132673 | 115132 | 128641 | 134678 |

Price $M/T | 1503 | 3117 | 5540 | 4521 | 2904 | 3501 | 2730 | 2523 | 2457 | 2445 |

Source: Central Bank of Sudan (CBOS) – (Statistics &Research Dept.)-2014

Table (4) World Exports of Raw Gum Arabic (2001-2010)

Country | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

Sudan | 26105 | 34382 | 13217 | 27444 | 33079 | 23149 | 16316 | 37860 | 36636 | 48598 |

Nigeria | 8747 | 6556 | 0050 | 15407 | 19313 | 21231 | 14463 | 14124 | 40862 | 34780 |

Chad | 12891 | 10664 | 9672 | 12044 | 14188 | 17816 | 11860 | 16219 | 9417 | 9509 |

Others | 2137 | 2724 | 3097 | 2393 | 3930 | 3474 | 4329 | 5964 | 3959 | 3133 |

Source: ITC (Trade Map) based on COMTRADE statistical data-2010

Table (5) Major Exporting Countries (2001-2010)

Country | Average | Total | Percentage |

Sudan | 29,678 | 296,786 | 47% |

Nigeria | 17,553 | 175,533 | 28% |

Chad | 12,428 | 124,280 | 20% |

Others | 3,424 | 34,240 | 5% |

Total | 63,083 | 630,839 | 100% |

Source: Researchers-Computed from table (4)-2014.

Table (6) Producers Sale Prices in SDG/Kantar (2004-2013)

Year | Price /Kantar |

2004 | 75 |

2005 | 120 |

2006 | 70 |

2007 | 80 |

2008 | 100 |

2009 | 150 |

2010 | 300 |

2011 | 500 |

2012 | 700 |

2013 | 850 |

Source: GAC – annual reports -2014

POLICY NOTE

Public Disclosure Authorized

Export Marketing of Gum Arabic from Sudan

March 2007

1-Summary

Sudan is the world’s largest producer of gum Arabic, which is one of the four important agricultural export commodities from Sudan, along with livestock, cotton and sesame. Over the last 20 years, gum Arabic export value amounted on average to $US 40 million annually. While there has been government intervention in the marketing of all agricultural exports in the past, gum Arabic is the only one for which government controls remain.

Gum Arabic is mostly produced by small-scale farmers in traditional rainfed farming areas. They represent up to 20 percent of Sudan’s population and are among the poorest.

The impact of the current gum Arabic marketing policy has not been beneficial to this group. This has led to reduced production and consequently exports, declining for the past forty years at an average rate of 2.2 percent per annum.

One of the key commitments made by the Government of National Unity under the Joint Assessment Mission framework was to “abolish the export monopoly” over raw gum Arabic. This commitment has not been implemented.

The development of the processing industry over the last three years has resulted in increased domestic competition for raw gum, and in turn better prices paid to farmers as well as more value added captured in Sudan. This positive development comes at a propitious time as increased consumption of soft drinks and confectionary products, as well as rapid development of health and dietetic products is boosting the world demand for gum Arabic.

This paper suggests that decontrol of the gum Arabic export market could increase export revenues for Sudan and raise significantly the income of small scale farmers.

2- Objectives

The objective of this policy note is twofold:

(a) to assess the impact of the Government policy for the export marketing of gum Arabic,

(b) to identify options for changing the current marketing arrangements in order to increase and stabilize gum exports, capture more value added in Sudan and provide producers with a larger share of export prices.

- Importance of Gum Arabic / Background

- Gum Arabic is the dried exudate produced from the trunk and branches of the Acacia Senegal tree, known as hashab or hard gum, and the Acacia Seyal tree, known as Talha or flaky gum. Gum Arabic is a pale white to orange brown solid which breaks with a glassy fracture. If stored properly, it stays unaltered for decades. Gum Arabic is a complex polysaccharide that has food, pharmaceutical and technical applications; its known uses go back about 5,000 years.

- Sudan is the world’s largest producer of gum Arabic. It produces mostly hashab2, principally in the traditional rainfed areas of western and central Sudan (see Annex 1). Gum Arabic is produced across sub-Saharan Africa, from Senegal, Mali and Nigeria to Ethiopia and North of Kenya.

- The supplementary revenues generated by gum Arabic are crucial to the livelihoods of about 6 million people in Sudan who live in traditional rainfed farming areas, where the incidence of rural poverty is in the range of 65 to 90 percent.

- Gum Arabic is primarily produced by small-scale farmers who give priority to food crop production (usually sorghum or millet) to secure family nutritional needs but seek other sources of income to meet the household’s basic needs other than grains. They harvest gum Arabic because this activity constitutes a crop diversification strategy to mitigate crop failure. In addition, the acacia tree’s long lateral root system reduces soil and wind erosion. It has a regenerating impact on the land[1] However, gum Arabic production does compete with food and cash crops for labor resources and land allocation (see Annex 1).

- Agricultural operations, including gum Arabic harvesting, are primarily financed by village traders using the Sheil system. Typically, the traders provide cash, seeds, tools but also basic commodities (water, sugar, tea…) for the households to get by during the “hunger gap”. Farmers pay back in kind at prices determined early in the season and usually integrating important credit charges. World trade of gum Arabic[2]

- All the gum Arabic produced in Sudan, mostly hashab, is exported. Sudan has always been the largest world producer and exporter of gum. From the 50’s to the early 90’s, Sudanese gum accounted for 80 percent of the global gum trade[3].

- However, considerable year-to-year variations and overall declining gum exports from Sudan – consequences of two severe Sahalian droughts (mid-70s and mid-80s), political unrest and inadequate marketing arrangements – have resulted in the emergence of new gum producing countries, chiefly Chad and Nigeria, which produce mostly Talha. Over the last 15 years, Sudan’s share in the world markets has declined sharply and is now below 50 percent. World exports of Talha are almost on par with exports of hashab (see Annex 1).

- Gum Arabic is used for its properties as an emulsifier, thickener, binder, stabilizer and adhesive. It is believed that soft drinks and confectionary represent 70 percent of the demand for gum Arabic.

- Gum Arabic is generally used as an additive which represents a small portion of the cost of the finished product. It is regarded by end users as having technical advantages which makes it difficult to replace completely in many applications . This makes demand for gum quite price inelastic; supply is the key factor on the demand side.

Figure 1: Gum Arabic Exports from Sudan (1970 to 2005)

Source: Gum Arabic Company

Figure 2. World Trade of Raw Gum Arabic

Source: Macrae, J. and Merlin, G – WB

World Demand for Gum Arabic.

- In the 70s and 80’s, because of reduced supply from Sudan, end-users started to integrate substitutes (principally starches). However, since the 90’s, with the emergence of Chad and Nigeria as gum Talha producers, use of substitutes has reduced sharply[4].

- Talha has become hashab’s main competitor[5]. Talha gum is substantially cheaper than hashab because it has inferior technical properties for some of gum Arabic’s important uses such as in the soft drinks industry but has the same chemical composition (see Annex 1).

- Demand for gum Arabic is driven up by the increasing world consumption of soft drinks and sweets. It is reinforced by the attention given by consumers to food products’ quality and naturalness. Because of its high fiber content, gum Arabic has recently found anew range of applications in the dietetic food and health sub-sectors[6].

- Four processors account for about 70 percent of the world trade of raw gum. Based in Europe and the USA, they buy raw gum for further transformation and re-sale as additive for the industry. The USA is the largest single market for gum Arabic, accounting for approximately 30 percent of the total trade. Europe is around 20 percent of the world trade. Confectionary represents the major use for gum in Europe while soft drinks production is the largest in the USA. Japan accounts for a little less than 10 percent of world trade. India, South Korea and China are emerging markets; it is believed that the demand from these countries is mainly for Talha.

- Gum Arabic Marketing in Sudan

- Export marketing of gum Arabic for Sudan has been characterized by the monopoly of the Gum Arabic Company over export of raw gum Arabic and, over the last fifteen years, by the assumed strong influence GAC’s main four international agents have had on GAC export prices. This cartel situation has translated into low prices paid to farmers, and in turn declining gum production and exports. However, since the recent development of the Sudanese processing industry, farmers have started to receive better prices, thus stimulating production, and more value added has been captured in Sudan.

The Gum Arabic Company

- In 1969, the Minister of Supply and Internal Trade granted the Gum Arabic Company (GAC), a public company incorporated under the Companies Ordinance of 1925, an exclusive concession to export raw gum Arabic. The Grant of Concession Act stipulates that GAC is empowered to buy from licensed local dealers and “is obliged to pay special attention to the quality, shipments schedules and any other aspect that may promote the export of gum”.

- Granting GAC an exclusive concession over raw gum Arabic export[7] had one main objective: to exercise market power at the international level (i.e. to regulate exports to achieve advantages in price) in order to support the country’s export revenues in foreign currency. This was justified by Sudan’s large share of the world market. Two other objectives were: (a) to guarantee production and protect producers through the provision of a minimum price policy (floor price) and the implementation of gum production development programs (through provision of water, seedlings, research services…)[8], and (b) to protect the environment because of the expectation that the policy would encourage the maintenance of gum Arabic trees.

- The involvement of the Sudanese government in GAC management is very strong: the board of the Gum Arabic Company is chaired by the Under Secretary of the Ministry of Trade, and comprises the General Manager of the National Forest Corporation, the Governor of the Central Bank of Sudan, in addition to representatives of the Sudan Farmers Union.

Main features and impact of the GAC exclusive concession

- Every year, two months before tapping starts, the GAC announces the export price (fob Port Sudan). It is set based on the marketing strategy of GAC which takes into consideration information on world demand provided by GAC’s agents overseas, the anticipated availability of gum production, and stocks. The export price is used as the starting point for the calculation of a floor price[9]. It is also used as a benchmark by exporters in other countries, i.e Chad and Nigeria for setting the price for their gum Arabic.

- GAC enforces the announced floor price at auction markets[10], where raw gum Arabic is purchased by independent buyers[11] who clean, grade and sell their gum to the GAC or processors. If gum Arabic is not bought or not offered the floor price at auction, GAC has the obligation to procure at the floor price.

- Taxes are levied at locality level[12]; they represent currently between $200 to $400/MT (see Annex 2). Additional taxes are collected from transport operators by localities on the way to Khartoum and Port Sudan where GAC and processors have their stores and processing facilities; processors and transporters claim that some of these taxes are illegal.

- Box 1 describes the four grades of gum Arabic currently exported, namely (a) hand picked selected (HPS): (b) kibbled (including the cleaned grade); (c) mechanical powder; and (d) spray dried powder.

Box 1: The Four Grades of Gum Arabic Exported from Sudan

Hand Picked Selected (HPS) is raw globules of clean gum Arabic specially sorted and graded. It represents 10 percent of export which goes mostly to Japan for further processing into powder. Kibbling is a process that involves breaking down gum lumps with hammer mills to produce smaller and more uniform granules. The Sudanese Standard and Metrology Office (SSMO) has established two specifications for kibbled gum: (a) kibbled grade: granules with a maximum size of 14 mm and a minimum size of 3mm and a maximum range of 8mm; and (b) the cleaned grade: gum lumps broken manually, with no limit on the granule size. The clean grade is considered raw gum by buyers; it constitutes GAC’s main export. Spray drying is a process by which raw gum is dissolved in water, centrifuged to remove impurities, pasteurized and sprayed in hot air to evaporate water. Spray drying produces free-flowing powder with high solubility. Spray drying process is similar to milk powder production; the same production technology is used. Mechanical powdering consists of crushing raw gum until free-flowing powder is obtained. It is less energy consuming than spray drying, therefore cheaper to produce and less subject to bacterial contamination. |

Until the recent development of processing in Sudan, all the gum Arabic from Sudan was exported by GAC in raw form. A few facts have accumulated on the marketing and amounts of gum Arabic exported by GAC:

- The cleaned grade, which constitutes the bulk of GAC’s exports, is exported mostly via the GAC “international agents”[13]: international companies which are GAC marketing agents with exclusive rights. Four of these international agents buy an estimated 70 percent of the GAC’s exports[14]; they have their own processing capacity, and sell processed gum (usually powder or spray dried) to large confectionary and soft drinks manufacturers in Europe and the USA.